Role in Business Operations

Tracking Financial Performance

Accountants play a central role in monitoring a company’s financial performance, ensuring that revenues, expenses, and cash flow are properly recorded and managed. By analyzing financial statements and reports, they identify trends, inefficiencies, and areas where resources may be wasted. This insight allows businesses to optimize operations, reduce unnecessary costs, and maintain a healthy financial position. Accurate financial tracking also provides a clear snapshot for management to make timely and informed decisions, whether it’s adjusting production schedules, controlling overhead, or planning for expansion.

Supporting Strategic Decisions

Beyond day-to-day bookkeeping, accountants contribute significantly to strategic decision-making. They provide management with detailed financial analyses, forecasts, and scenario planning that inform critical operational choices. For example, accountants can assess the financial feasibility of new projects, expansion initiatives, or technology investments. Their guidance helps organizations balance risk and reward, allocate resources efficiently, and set achievable financial goals. Essentially, accountants bridge the gap between numbers and strategy, transforming raw financial data into actionable business intelligence.

Advising Management

In many organizations, accountants serve as trusted advisors to executives and department heads. They interpret complex financial data and translate it into insights that help management understand the impact of decisions on profitability, cash flow, and long-term sustainability. This advisory role often extends to providing recommendations on cost reduction, investment opportunities, and operational improvements. By guiding management in this way, accountants become indispensable partners in shaping business strategy and ensuring sustainable growth.

Level of Education and Certification

Formal Education

A strong educational background is fundamental for accountants to manage complex financial tasks effectively. Most accountants hold degrees in accounting, finance, or related disciplines, which provide the technical foundation needed for bookkeeping, reporting, and financial analysis. Higher education equips them with knowledge of accounting principles, financial management, auditing standards, and tax regulations. This formal training is essential for understanding the nuances of accounting practices and interpreting financial data accurately.

Professional Certifications

In addition to formal education, professional certifications such as CPA (Certified Public Accountant), CMA (Certified Management Accountant), or ACCA (Association of Chartered Certified Accountants) further validate an accountant’s expertise. These certifications demonstrate mastery of accounting standards, ethics, and advanced financial management practices. They are particularly important for specialized areas such as auditing, tax planning, or management accounting, and often enhance career opportunities, credibility, and authority within an organization.

Impact on Responsibilities

The level of education and certification directly influences an accountant’s scope of responsibilities. Highly qualified accountants often take on leadership roles, such as managing financial teams, overseeing budgets, or participating in strategic planning. Conversely, entry-level accountants focus on foundational tasks like recording transactions or preparing basic reports. By combining education and certification, accountants can handle increasingly complex financial challenges, contribute to decision-making, and add strategic value to the organization.

The Depth of Financial Analysis

Evaluating Financial Data

Accountants analyze financial data to uncover patterns, identify trends, and evaluate business performance. This involves reviewing income statements, balance sheets, and cash flow reports to detect variances, inefficiencies, or opportunities. Effective analysis requires attention to detail, an understanding of financial ratios, and the ability to interpret how numbers reflect operational realities. Through this evaluation, accountants provide a comprehensive picture of a company’s financial health, enabling proactive management.

Providing Insights for Decisions

Financial analysis is not just about reporting numbers; it’s about offering actionable insights. Accountants help management make informed decisions on pricing strategies, cost management, investment opportunities, and risk mitigation. They provide scenario analyses and forecasts that guide strategic planning and resource allocation. By interpreting financial data, accountants empower businesses to make decisions that align with short-term goals and long-term growth objectives.

Beyond Basic Bookkeeping

Skilled accountants go beyond routine bookkeeping tasks by applying analytical and strategic thinking. They use financial insights to improve operational efficiency, optimize costs, and enhance profitability. Their role extends to advising on business expansion, capital investment, and process improvement initiatives. In essence, accountants transform financial data into a roadmap for organizational success, influencing both daily operations and long-term strategic decisions.

Knowledge and Implementation of Regulatory Standards

Understanding Tax Laws and Compliance

Accountants must have in-depth knowledge of tax laws, reporting standards, and industry-specific regulations. This expertise ensures that businesses remain compliant with legal requirements and avoid penalties or audits. Staying current with regulatory changes is essential, as even minor mistakes can result in financial or legal repercussions. Accountants also help organizations understand how regulations impact business decisions, ensuring compliance while supporting growth strategies.

Implementing Standards Effectively

Applying regulatory standards accurately is a critical part of an accountant’s responsibilities. This involves ensuring that all financial statements, reports, and filings meet required guidelines, and that internal processes align with best practices. By effectively implementing these standards, accountants minimize risk, enhance transparency, and provide stakeholders with confidence in the company’s financial integrity.

Building Trust with Stakeholders

Accurate and compliant financial reporting builds trust with investors, creditors, regulators, and internal stakeholders. By demonstrating adherence to regulatory standards, accountants strengthen a company’s credibility and reliability. This trust is essential for securing investment, negotiating financing, and maintaining strong business relationships. Accountants play a key role in fostering confidence and accountability through diligent compliance and reporting.

Level of Decision Making

Advisory Role

Accountants provide recommendations that influence critical business decisions, from budgeting and pricing to investment and risk management. They evaluate financial data and present actionable insights that guide management in making informed choices. Their advisory role is particularly important for decisions that affect profitability, cash flow, and long-term sustainability.

Supporting Management

Entry-level accountants primarily provide data, analysis, and reports that management relies on for operational decisions. By ensuring accurate and timely financial information, they enable managers to assess performance and make short-term operational choices effectively. Their contributions lay the foundation for strategic decision-making by higher management levels.

Strategic Influence

Senior accountants and financial managers often participate directly in strategic planning. They use financial forecasts, scenario analysis, and performance metrics to guide business expansion, investment, and process optimization. Their input ensures that strategic decisions are grounded in financial reality, reducing risk and maximizing the potential for long-term success.

Compensation and Hiring Costs

Salary and Benefits

Hiring accountants involves a financial investment in salaries, benefits, and professional development. Compensation reflects the complexity of responsibilities, level of expertise, and certifications held by the accountant. Competitive salaries are necessary to attract skilled professionals who can manage critical financial operations effectively.

Training and Development

Organizations also invest in ongoing training, certifications, and professional development to ensure accountants remain up-to-date with changing regulations and best practices. This continuous learning enhances their effectiveness, supports compliance, and improves strategic decision-making capabilities.

Return on Investment

While hiring qualified accountants incurs costs, the benefits far outweigh the expense. Skilled accountants help optimize operations, reduce errors, ensure regulatory compliance, and contribute to strategic growth. The financial and operational advantages they bring create a strong return on investment for the organization.

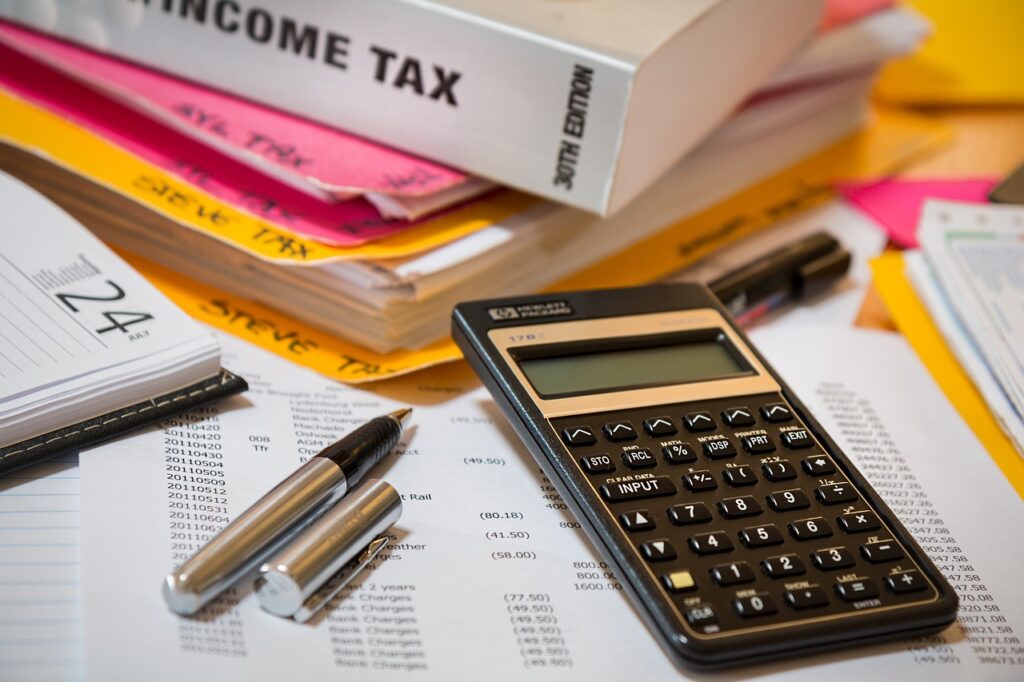

The Role in Tax Preparation and Filing

Accurate Tax Compliance

Accountants ensure that all tax obligations are met accurately and on time. This involves calculating liabilities, preparing returns, and submitting filings in accordance with regulations. Proper compliance reduces the risk of penalties, audits, and legal issues.

Strategic Tax Planning

Beyond filing, accountants provide strategic advice to minimize tax burdens. They identify eligible deductions, credits, and incentives, helping businesses optimize their tax strategy while aligning with long-term financial goals.

Reducing Risk

By managing tax preparation and filing efficiently, accountants reduce exposure to financial and legal risks. Their careful planning and execution safeguard the organization against errors, audits, and potential disputes with tax authorities, ensuring both compliance and financial stability.

Pingback: 7 Helpful Insights into Cost Accounting for Small Business – Esvea Accounting ™

Pingback: What is Goodwill in Accounting and 7 Ways It Adds Value – Esvea Accounting ™