Intro

Do you run a business? Have you heard of forensic accounting? It may sound like a complicated term, but it’s actually a very useful tool for businesses. Forensic accounting is a specialized field that helps uncover financial fraud and discrepancies within a company. In simpler terms, it’s like being a financial detective for your business. But did you know that forensic accounting can do much more than just catch fraudsters? In fact, it can offer surprising benefits to your business that you may not have considered before. In this blog post, we’ll explore 5 ways that forensic accounting can help your business grow and thrive.

Continue reading to learn more about how ‘5 Ways Forensic Accounting Can Help Your Business’ can help your business.

Finding the Hidden Money

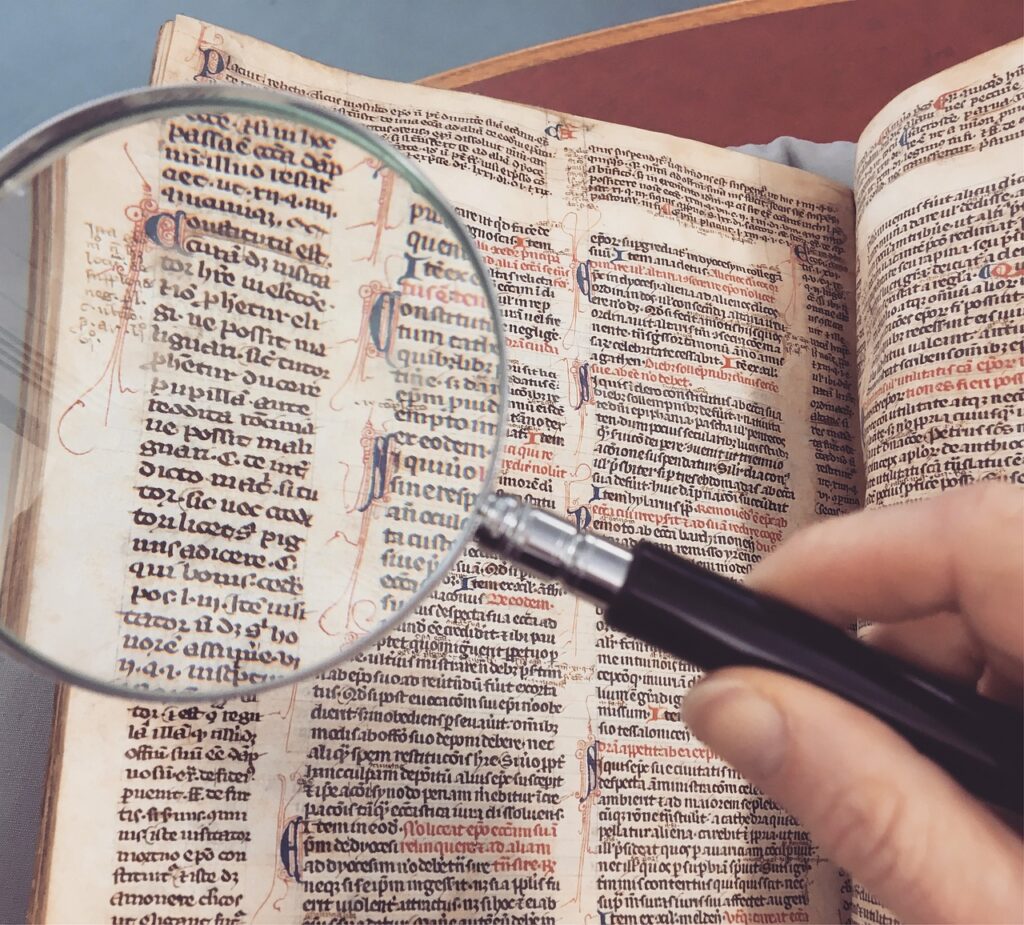

Have you ever been excited to find a crumpled dollar bill hiding under your sofa cushions? That’s the feeling you get when a forensic accountant uncovers hidden money in your business. They put on their thinking caps, grab their financial magnifying glasses, and dive into your company’s financial jungle.

Forensic accountants are financial detectives who use a special tool called data analytics. Think of data analytics as a magical map that guides them through mountains of numbers, highlighting any unusual patterns or discrepancies. These unusual patterns could be a sign of hidden or misplaced money. Just like finding that lost dollar under the couch, uncovering this money can bring a sense of relief and excitement. This isn’t just any money – it’s your money that was out of sight but can now be put to work for your business!

They dig through all kinds of financial records, like sales reports, expense accounts, and payroll records. Their keen eyes and sharp minds can spot things that others might miss. Imagine them as super-smart squirrels, tirelessly hunting for financial acorns that are hidden away in your business’s accounting tree.

So, if you’re feeling like there’s a financial puzzle that you just can’t solve, a forensic accountant might be the hero you need. They can bring your hidden money back into the light, helping you use it in ways that can grow and strengthen your business. And who knows, they might even uncover more than you expected!

Continue reading to learn more about ‘5 Ways Forensic Accounting Can Help Your Business’.

Catching the Bad Guys

Picture this: a superhero, swooping in to save the day from sneaky villains trying to steal your hard-earned money. That’s what a forensic accountant does for your business! These are the people who stand on the front lines, ready to protect your business from white-collar criminals – the sly foxes who might be hiding in your ranks or lurking outside, ready to snatch away your profits through crafty tricks and schemes.

But how do they do it? How does a forensic accountant spot these sly villains when others can’t? Well, it’s all down to their super accounting powers! They have a sharp eye for detail, a brain that can crunch numbers like a calculator, and a knack for smelling out anything fishy.

Using these special abilities, a forensic accountant can spot those who try to fool your business with fraudulent tricks, counterfeit cheques, and other scammy practices. But it doesn’t stop there! Once these financial crime-fighters spot the villains, they work tirelessly to gather evidence, using every financial document, every number, and every piece of data they can find.

And their mission doesn’t end at simply catching the bad guys. They also work closely with legal teams, providing them with the proof they need to bring the villains to justice. This ensures your money stays safely tucked away in your business coffers, rather than lining the pockets of some sneaky scam artist.

So, let your forensic accountant don their cape and keep a vigilant watch over your business. With them on your side, you can rest easy knowing your profits are protected, and your business is safe from financial tricksters.

These ‘5 Ways Forensic Accounting Can Help Your Business’ can really help your business.

Keeping Your Business Healthy

Ever gone to the doctor for a regular check-up to make sure you’re as healthy as can be? A forensic accountant does a similar kind of ‘health check’ for your business. It’s like they’re the doctors of your business, using a stethoscope to listen to your company’s financial heartbeat. This process is known as due diligence.

Just like you need to eat right, exercise, and get plenty of sleep to stay healthy, your business needs to maintain healthy financial habits. They can help make sure that’s happening. A forensic accountant dives deep into the sea of numbers and data that your business produces every day, inspecting everything from your company’s income and expenses to its assets and liabilities.

They scrutinize every transaction, look at every account, and analyze all your financial data. Imagine them as a gardener, carefully examining each leaf of your business tree, looking for any signs of disease or pests. If they find any financial bugs or signs of rot, they can help you nip them in the bud before they turn into serious problems.

And just like a doctor doesn’t just focus on treating sickness, but also on promoting overall wellness, they doesn’t just look for problems. They also identify what’s working well, so you can do more of it. Maybe they find an area where your business is particularly profitable, or perhaps they spot a cost-saving measure you didn’t realize was so effective. They shine a spotlight on these positive aspects, helping you make the most of your business’s strengths.

Having them perform due diligence on your business is like having a regular health check-up. It keeps your business in shape, ready to run the marathon of success. Plus, it can catch any potential issues early, before they become too big and difficult to handle.

Helping to Solve Money Puzzles

Ever had a tough time solving a jigsaw puzzle? Money matters in your business can sometimes feel just like that – full of pieces that just don’t seem to fit together. Maybe there are numbers that look out of place, or perhaps your sales records aren’t adding up to your profits. This is when a forensic accountant turns into your very own money detective! They use their smarts, their understanding of accounting principles, and their special data analytics tool to figure out these financial puzzles.

Imagine your business financials like a big jigsaw puzzle, and the forensic accountant as a master puzzle solver. They don’t just randomly try to fit pieces together, but carefully analyze each piece. Forensic accountants have a keen eye for noticing if a piece is missing, or if one seems to be from a completely different puzzle!

They dig deep into your business’s financial picture, looking at sales receipts, expense reports, and bank statements. They analyze where your money is coming from, where it’s going, and if there are any strange patterns. These could be pieces of the puzzle that don’t fit, like unusually high expenses, or sales records that don’t match up with your profits.

Using their knowledge of accounting principles, they can figure out how these pieces are supposed to fit together. They look at the big picture and the small details, using their understanding of numbers, patterns, and money flows to put the pieces in the right places.

And here’s the best part – once they’ve solved the puzzle, they don’t just leave it there. They help you understand the picture that’s been formed. They’ll explain what each piece of the puzzle means for your business, how they fit together, and what it all means for your bottom line.

Saving You from Money Troubles

Imagine playing a game of dodgeball. The balls coming your way are tax evasion and money laundering. You could be facing hefty fines or, worse, some scary jail time. Whoosh! Here comes a forensic accountant, just in time to catch those balls and toss them away, saving your business from getting hit.

Forensic accountants are like the goalkeepers of your business’s financial soccer team. They have been trained to identify the signs of these financial fouls and can block them before they make a goal against your business. They know all the tricks that some people might use to try and cheat the system and can make sure your business isn’t inadvertently doing anything wrong.

Imagine if you could have your very own financial superhero, who swoops in just in time to save your business from these potential threats. A forensic accountant is just that hero. They are skilled at spotting the red flags that signal tax evasion or money laundering, two crimes that can really knock your business off its feet if left unnoticed.

Think of it like having your very own guard dog, who sniffs out any trouble before it can harm your business. They keep their eyes and ears open, constantly on the lookout for anything that seems fishy or out of place. And if they spot something, they’ll dig deeper, doing their best to understand what’s going on and, if necessary, help correct it.

Remember, it’s not just about avoiding getting in trouble. It’s also about making sure your business is doing things the right way, following all the rules and regulations. And when your business does things right, it builds a good reputation, which can lead to more customers and more success.

Pingback: 7 Easy Ways to Grasp the Concept of Managerial Accounting – Esvea Accounting ™